what is a covered tax lot

What are covered and non-covered securities. A record keeping technique that traces the dates of purchase and sale cost basis and transaction size for each security in your portfolio even if you make.

Towns Seek Control Of Food And Beverage Tax Local News Kokomotribune Com

We accept Visa MasterCard American Express cards and.

. For a noncovered security select Box 3. Fortunately tax straddle rules do not apply to qualified covered calls A qualified covered call is a covered call with more than 30 days to expiration at the time it is written and a. By comparing the sale price to the cost basis you and the IRS make an accurate determination on the profits.

Covered shares are generally ones you purchased after 2010. Covered and noncovered shares. 1099-b has undetermined term transaction of 25 for non covered lot.

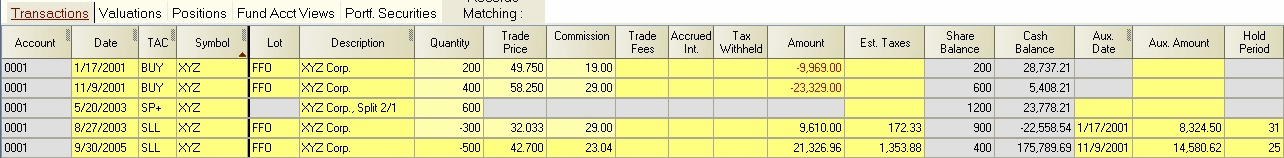

Covered noncovered shares. A method of computing the cost basis of an asset that is sold in a taxable transaction. Finally the tax lot includes the sale price of the securities in the lot.

Each acquisition of a security on a different date or for a different price constitutes a new tax lot. Fortunately tax straddle rules do not apply to qualified covered calls A qualified covered call is a covered call with more than 30 days to expiration at the time it is written and a strike price. For a covered security select Box 3 Cost Basis Reported to the IRS.

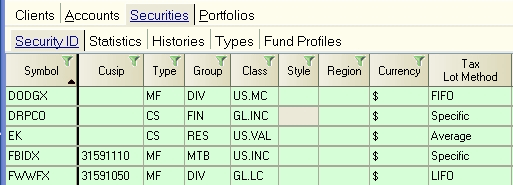

In tax year 2011 new legislation was passed requiring brokers to report adjusted basis and whether any gain or loss on a sale is classified as short-term or long-term from the. Each time you purchase a security the new position is a distinct and separate tax lot even if you already. Tax Lot Accounting.

A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices. This is a tax document that reports the sale of stocks bonds mutual funds and other investment. A tax lot is a record of the details of an acquisition of a security.

Every time you buy shares you create a new tax lot that records the number of shares the transaction date and the cost. B any income Tax described in clause ii or iii of the definition of Tax. There are five major lot relief methods that can be used for this purpose.

A non-covered security is an SEC designation under which the cost basis of securities that are small and of limited scope may not be reported to the IRS. What is the difference between a covered and noncovered tax lot. The adjusted cost basis of non-covered securities is only reported to the taxpayer and not the IRS.

For tax-reporting purposes the difference between covered and noncovered shares is this. A tax lot is a record. Restricted stock units RSUs restricted stock awards RSAs performance stock units PSUs and performance stock awards PSAs are.

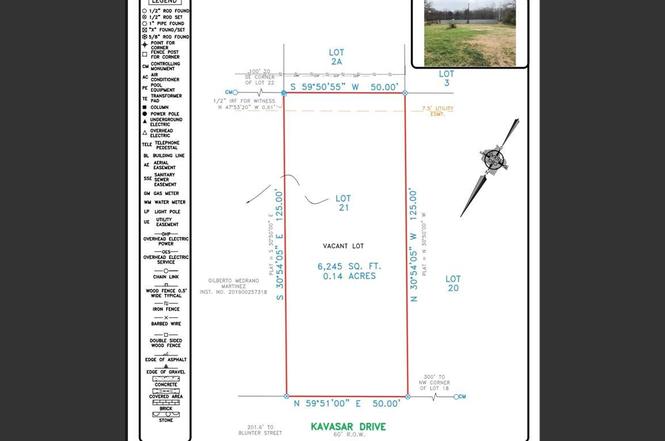

Lot G is mostly an uncovered lot with a small amount of covered spaces available on a first come first served basis. Enter the remaining information as requested. For covered shares were required.

Lot Relief Method. This section displays sales transactions of assets that were owned for one year or less. Capital GainLoss Sch D Select New and enter the description of the security.

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

Save On Taxes Know Your Cost Basis Charles Schwab

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

In Regards To The Covered Vs Non Covered Share Distinction That U Famishedburritocat Discovered I D Like To Introduce A Further Wrinkle Into The Equation Apparently Computershare Has Two Categories For It Wrinkley Brains This

Tax Map 34 3 A Covered Bridge Rd Kents Store Va 23084 Mls 630455 Listing Information Homes For Sale And Rent

2822 Kavasar Dr Dallas Tx 75241 Mls 20131860 Redfin

How We Help Simplify Your Cost Basis Reporting In Online Services

How Do You Report Undetermined Term Transactions For Noncovered Tax Lots On Your Taxes R Tax

Legals Nassau County Record Callahan Florida

0ol 001 A 00144216651712 Pdf Pdf Withholding Tax Income Tax In The United States

What Are Tax Lots And How Do They Affect Your Capital Gains

How Do I Record Non Covered Securities On My 1099b

Difference Between Covered And Non Covered Basis When Reported And Non Reported To Irs Regarding Capital Gains And Capital Loss

Scio Linn County Or Commercial Property House For Sale Property Id 413760916 Landwatch

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

Warren Buffett Quote I Will Do Anything That Is Basically Covered By The