are political contributions tax deductible in oregon

Political contributions deductible status is a myth. Credit for Political Contributions 1 In General.

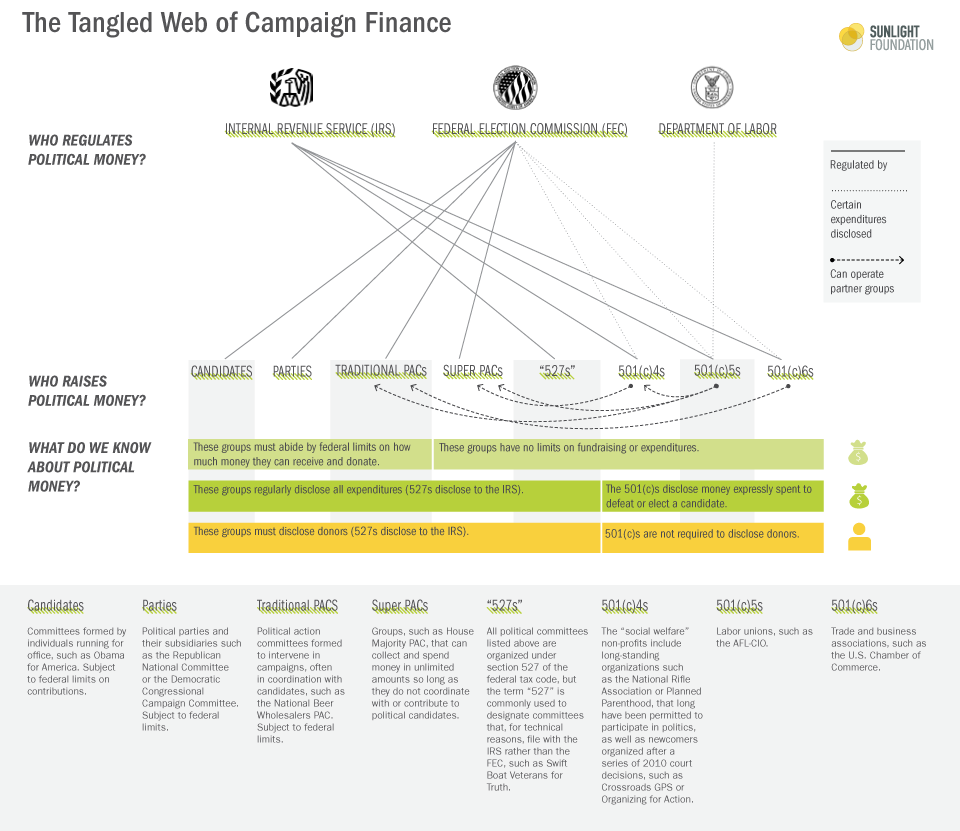

Campaign Finance In The United States Wikipedia

Generally speaking only contributions made to certain tax-exempt organizations.

. Political contributions are not deductible on your federal return but they are deductible in Montana and can lead to a tax credit in Arkansas Ohio and Oregon. In comparison those sent by individuals or businesses to non. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

1 a credit may. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to support political candidates. If you are one of those.

The tax credit amount is. According to Political contributions credit in Oregons Publication OR-17 Individual Income Tax Guide The AGI limit for claiming this credit has been lowered to 150000 for. Part-year and nonresident filers report these deductions and.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. June 4 2019 654 PM.

Just know that you wont. To qualify for the political contribution credit the contribution must be a voluntary contribution of money made to one of the following. Deductions and modifications for part-year and nonresident filers.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to. Charitable contributions claimed as Oregon tax payments. Political donations are not tax-deductible but contributions to churches mosques temples or other religious groups are taxed.

You cant deduct a charitable contribution for which you received an Oregon tax credit as a payment of Oregon. Oregon personal income tax. When you are in the State Taxes section for Oregon there is a screen titled Political Contribution Credit where you are able to enter the amount of your.

Arkansas ohio and oregon offer a tax credit while montana offers a tax deduction. List Of Are Donations To Political Campaigns Tax Deductible 2022. According to the IRS Most personal political contributions are not tax deductible.

As of 2020 four states have provisions for dealing.

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Working From Home In Washington For An Oregon Employer Solid State Tax Service

Are Political Donations Tax Deductible Credit Karma

Why Political Contributions Are Not Tax Deductible

Are There Campaign Donation Limits In Oregon Kgw Com

Money S Power In Politics Give Everyone A Share Cnn

Fec Candidate Who Can And Can T Contribute

Oregon Right To Life Pac Political Action Committee

Claim Your Oregon Political Tax Credit Peter Defazio For Congress Oregon S 4th

Use Your Oregon Political Tax Credit And Help Us Get Ip 10 To The Ballot

State Income Tax Rates And Brackets 2022 Tax Foundation

Are Political Contributions Tax Deductible H R Block

Political Action Tax Credits Explained Oregon Faith And Freedom

Why Political Contributions Are Not Tax Deductible

Who S Who In Oregon Politics Forward Together

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington